Buying a bond at a premium doesn’t mean you will lose money

- 06.16.25

- Markets & Investing

- Commentary

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

When a bond is purchased at a price greater than its maturity value, it is known as a premium bond. For example, if a bond that matures at a price of $100 is purchased at a price of $105, the bond was purchased at a premium. Investors that are new to the world of fixed income can sometimes be averse to purchasing bonds at a premium for fear that they are losing money by purchasing at a price higher than the redemption value. This is not the case (unless the bond is purchased at a negative yield). The yield tells an investor what their annual return will be if the bond is held until maturity, factoring in the price paid for the bond, the maturity value, the maturity date, and the coupon size and frequency. In essence, the yield factors in all relevant data points to provide the investor with a single number that allows them to judge the expected return on a bond.

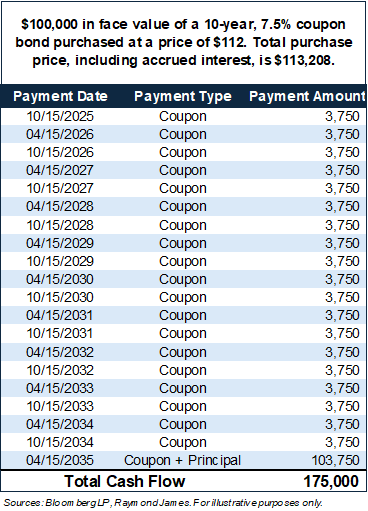

A bond priced at a premium does not mean that it is expensive or that it will lose the investor money; it simply means that its coupon is higher than its yield. All else being equal, it provides the investor with higher levels of coupon cash flow than lower-priced bonds. By paying more up front, an investor is purchasing more coupon cash flow over the life of the bond. To highlight the buying-a-bond-at-a-premium-doesn’t-mean-you-will-lose-money theme of this commentary, the illustration to he right walks through the lifetime cashflow provided for a bond purchased at a premium.

Over the life of this bond, the investor would receive $175,000 in cash flow (coupon payments + principal payment). The bond was purchased for $113,208. Yes, they bought the bond for more than its maturity value, but the investor did not lose money by purchasing a bond at a premium; they made $61,792.

It is all about the timing of the cash flows. Compared to a bond priced at par or a discount, a premium bond provides more cash flow along the way and less at maturity, whereas the par/discount bond provides less cash flow along the way and more at maturity. Neither is necessarily better or worse; it simply depends on the investor’s needs. Your financial advisor can help you construct a portfolio of individual bonds with a set of characteristics that is custom tailored to your specific needs.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.